Driving New Industrial Developments

Driving New Industrial Developments Corporate Governance

Corporate Governance Board of Directors, Audit Committee, Compensation Committee

Board of Directors, Audit Committee, Compensation Committee

Driving New Industrial Developments

Driving New Industrial Developments Corporate Governance

Corporate Governance Board of Directors, Audit Committee, Compensation Committee

Board of Directors, Audit Committee, Compensation Committee Overview of Board Operations

FPCC directors are elected to three-year terms via the candidate nomination system. The Corporate Governance Best Practice Principles was established to ensure the Board of Directors diversity policy is implemented and that directors have the knowledge, skills, competencies, and conflicts of interest avoidance mechanisms required to perform their duties. Please see the company website (http://www.fpcc.com.tw/tw/corporate/policies).

FPCC directors are elected to three-year terms via the candidate nomination system. The Corporate Governance Best Practice Principles was established to ensure the Board of Directors diversity policy is implemented and that directors have the knowledge, skills, competencies, and conflicts of interest avoidance mechanisms required to perform their duties. Please see the company website (http://www.fpcc.com.tw/tw/corporate/policies).

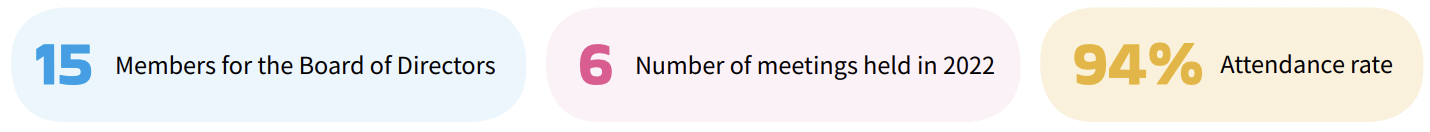

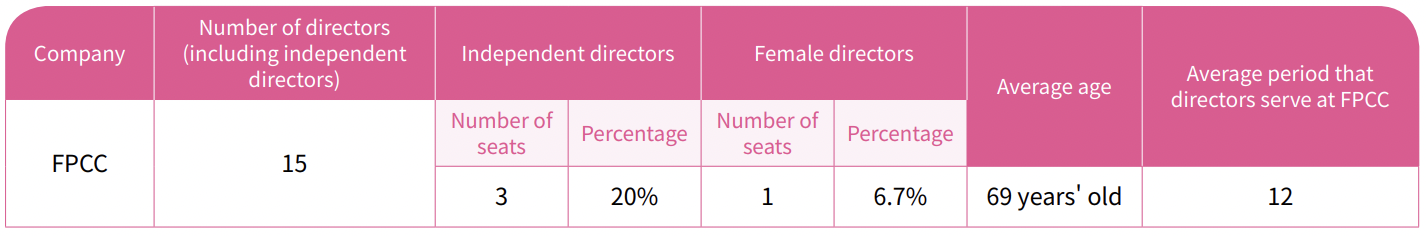

The Board of Directors currently has 15 members with an average age of 69 years old. Directors on average serve about 12 years at FPCC, in which 6.7% of directors are female, providing the most suitable strategies and guidance for the Company's development. To improve directors' professional competencies, legal literacy, and sensitivity to sustainability trends and green technology development, FPCC arranges courses for directors to gain new knowledge each year. For details on the academic background and experience of directors, their professional knowledge and independence, continuing education, and shareholding, please refer to our website (http://www.fpcc.com.tw/tw/corporate/board-of-directors) and the annual report disclosed at shareholders' meetings.

The Board of Directors, in principle, meets at least once a quarter. A total of 6 board meetings were held in 2022 with an attendance rate of 94%. The Board of Directors established the "Board of Directors Performance Evaluation Guidelines" in 2020. Annual performance evaluations are conducted for the Board of Directors and functional committees. Performance results of the overall Board of Directors and individual directors were excellent, and were submitted to the Board of Directors on December 8, 2022.

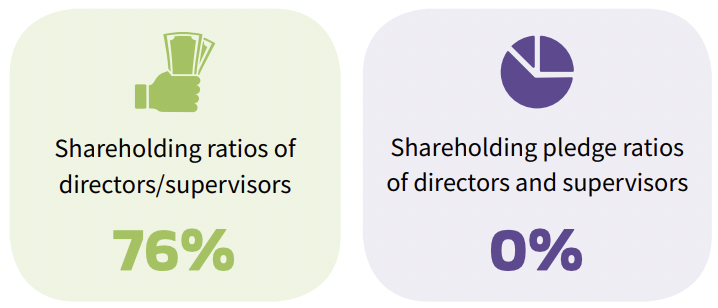

The shareholding ratios of directors and supervisors at FPCC has been around 76% for the past five years, which is far higher than the FSC's minimum requirement of 2% for public companies of the same size. Meanwhile, the shareholding pledge ratio of directors and supervisors is 0%. These ratios show that the Board of Directors and shareholders of FPCC are highly correlated in terms of interest and the former is thus trustworthy for the latter. The shareholding structure is disclosed on the company website (http://www.fpcc.com. tw/tw/corporate/ownership).

The shareholding ratios of directors and supervisors at FPCC has been around 76% for the past five years, which is far higher than the FSC's minimum requirement of 2% for public companies of the same size. Meanwhile, the shareholding pledge ratio of directors and supervisors is 0%. These ratios show that the Board of Directors and shareholders of FPCC are highly correlated in terms of interest and the former is thus trustworthy for the latter. The shareholding structure is disclosed on the company website (http://www.fpcc.com. tw/tw/corporate/ownership).

Overview of Audit Committee Operations

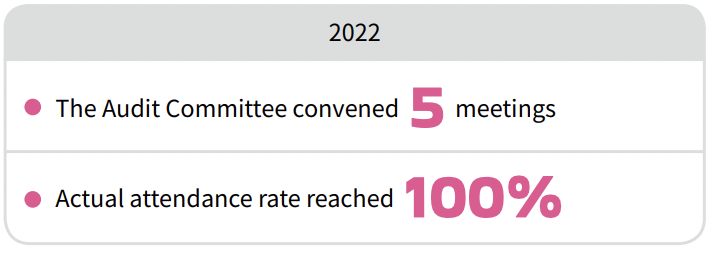

FPCC's Audit Committee is formed by 3 independent directors. The Audit Committee supervises the Company's business condition and financial position based on the principles of integrity and independence. It helps the Board of Directors carry out supervisory and other duties as set forth in the Company Act, the Securities and Exchange Act, and other related laws. Detailed data in Appendix ESG performance data – Economic.

Overview of Operation of the Compensation Committee

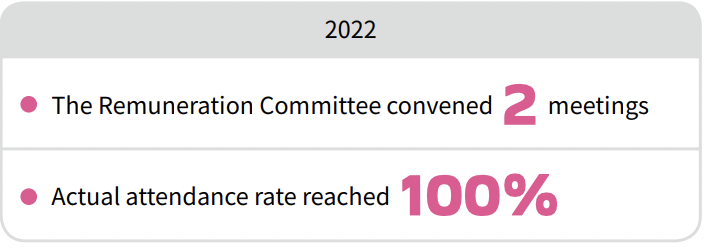

The Remuneration Committee's 3 members are all independent directors. The committee is responsible for evaluating the remuneration policy and system for the Company's directors and managers, and provides the Board of Directors with suggestions. This prevents remuneration policies from guiding directors and managers to violate business ethics and engage in behavior that exceeds the Company's risk appetite. Detailed data is provided in the Appendix ESG performance data – Economic.

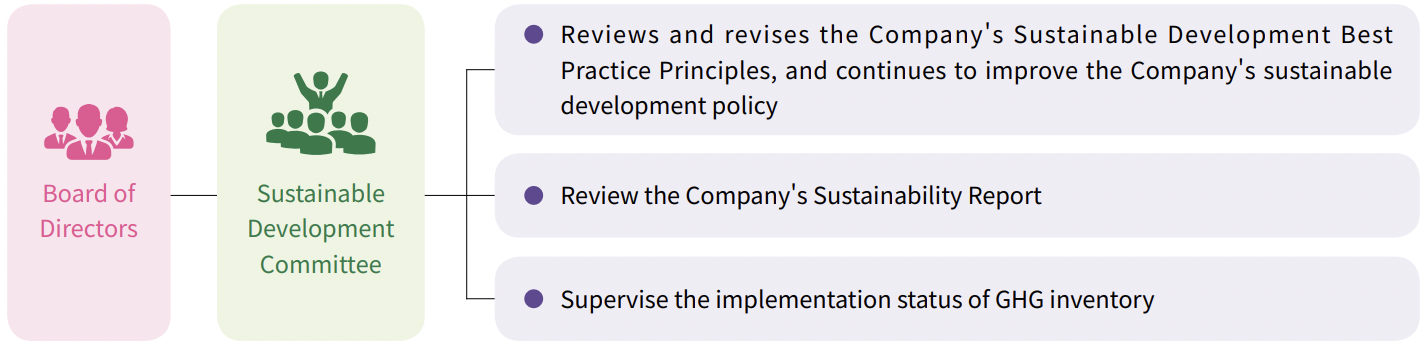

Operating status of the Sustainable Development Committee

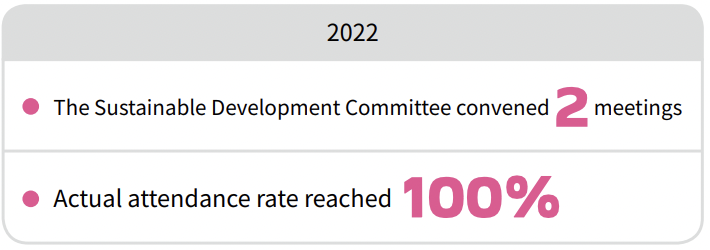

To meet requirements of the Corporate Governance Evaluation, the Sustainable Development Committee has 5 members and is responsible for reviewing the Company's sustainable development policy and management approach. The committee also supervises the implementation of tasks related to sustainable development, in order to strengthen the Company's resilience to climate change risks.

Compensation for directors and managers

Currently, only independent directors receive fixed compensation on a monthly basis. All directors do not receive variable compensation, and only receive transportation subsidies based on their actual attendance in Board meetings. Annual compensation for managers mainly includes the salary, incentives, and bonuses in addition to the pension fund and the welfare fund. The chairperson rates managers' overall performance and attainment of personal "annual objectives at work" within the scope of responsibilities, such as business performance, labor safety incidents, and energy and water conservation, so as to ensure that executives understand and work together to accomplish corporate strategic goals and to link the incentive system to the personal performance of supervisors as well as the overall corporate performance. Detailed data in Appendix ESG performance data – Economic.